maryland tesla tax credit

The Homestead Credit limits the increase in taxable assessments each year to a fixed percentage. Eligible purchase price on plug-in fuel cell.

Tesla In India Tesla India Team Takes Apac Route Auto News Et Auto

The credit can be claimed on Maryland forms 502 504 505 or 515.

. Thats where the catch comes in. The Maryland Electric Vehicle Tax Credit. Please be advised effective immediately the 6 million funding authorized by the Maryland Clean Cars Act of 2019 HB1246 as an excise tax credit for both Plug-In Electric Vehicles and Fuel Cell Electric Vehicles for Fiscal Year.

Tesla Service Baltimore 9428 Reisterstown Road Owings Mills MD 21117. Internal Revenue Code Section 30D IRC 30D introduced a credit for Qualified Plug-in Electric Drive Motor Vehicles that includes passenger vehicles and light trucks. For more information about claiming the credit see the Internal Revenue Service IRS Plug-In Electric Vehicle Credit website and IRS Form 8936 which is available on the IRS Forms and Publications website.

Maryland legislators have created a battery backup tax credit of 30 of your installed costs up to 5000. To apply for the Maryland Income Tax Credit Certificate please click here. Credits will be issued for tax years 2017 through 2019.

Select utilities may offer a solar incentive filed on behalf of the customer. Every county and municipality in Maryland is required to limit taxable assessment increases to 10 or. The credit amount is limited to the lesser of the individuals state tax liability for that year of the maximum allowable credit of 5000 per owner who qualifies to claim the credit.

The credit is for 10 of the cost of the qualified vehicle up to 2500. The Maryland legislature also has a bill to revive funding for the states electric vehicle state excise tax incentive worth up to 3000 for electric vehicles or plug-in hybrids. Federal and State Tax Incentives for Electric Vehicles in Pennsylvania and Maryland.

The tax credit is based upon the amount by which the property taxes exceed a percentage of your income according to the following formula. 65 of the next 4000 of income. In order to participate in the OPOB program customers must first apply for the rebate to determine eligibility.

This expands the tax credit from 3 million total to 6 million for FY 2020 beginning in July 2019. 1500 tax credit for lease of a new vehicle. The average car buyer in Maryland should expect to spend approximately 105 for the title registration.

Residential clean energy grant program. The credit may not extend to another taxable year. The program was in sore need of this credit.

The credit has a budget of 750000 annually and as of late 2020 theres still over 600000 in the pool. The rebate is up to 700 for. While the 7500 tax credit remains in this bill the legislation promises an additional 2500 if final vehicle assembly occurs in the US.

This program is paired with Pepcos 300 Residential Rebate offering. Then to extend the tax credit for two more years. Federal Income Tax Credit up to 7500 for the purchase of a qualifying Electric Vehicle or Plug-in Hybrid.

First was to fund the backlog of applications from EV purchasers who are on the waitlist from the prior EV tax credit program. Customers who have purchased and installed an eligible EV charger from July 2019 and on can apply for the 300 rebate as well. Maryland offers a rebate of 40 of the cost of Electric Vehicle Charging Equipment and Installation.

And finally it was to extend the EV charging equipment rebate. And if the MVA is keeping a waitlist of applications they may have already passed 3 million worth of waitlisted applications. This credit is applicable for vehicles acquired after December 31 2009 amounting to 2500 plus 417 for.

0 of the first 8000 of the combined household income. Funding is currently depleted for this Fiscal Year. 1500 tax credit for each plug-in hybrid electric vehicle purchased.

The chart below is printed in 1000. To help homeowners deal with large assessment increases on their principal residence state law has established the Homestead Property Tax Credit. Driving Directions Store Service 410 415-1411 Roadside Assistance 877 798-3752.

The main ones are. Non-competitive first-come first-served Anticipated Program Budget. 3000 tax credit for each plug-in or fuel cell electric vehicle purchased.

And 9 of all income above 16000. 2500 tax credit for purchase of a new vehicle. Maryland offers a credit of 100 per kilowatt-hour of battery capacity for a maximum 3000 rebate for electric vehicles or plug-in hybrids.

Applicants are encouraged to thoroughly review the FY22 EVSE Rebate Program guidelines below. The total amount of funding currently available for this rebate program in state fiscal year FY 2022 7121- 63022 is up to 1800000. It previously ran out in November 2018 after just 4 months.

On top of the federal governments flagship solar Investment Tax Credit ITC which effectively reduces the cost of your solar energy system by 26 percent MD has a couple of great solar policies that decrease the up-front cost of solar and increase the amount of money your system will generate. The certificate will be issued in the amount of 400 per vehicle and limited to 10000 maximum 25 vehicles for one taxpayer. At that rate you dont have to worry about the credit exhausting itself this year or probably next.

4 of the next 4000 of income. Battery capacity must be at least 50 kilowatt-hours. Electric car buyers can receive a federal tax credit worth 2500 to 7500.

Maryland Excise Tax Credit up to a maximum of 3000 for Electric Vehicle or Plug-in Hybrid. Store Hours Monday 1000am - 700pm Tuesday 1000am - 700pm Wednesday 1000am - 700pm. The Clean Cars Act of 2021 as introduced had several goals.

Tax credits depend on the size of the vehicle and the capacity of its battery.

Tesla New Chip Tesla Introduces New Amd Chip 12v Li Ion Battery In Some Vehicles Auto News Et Auto

Used Electric Cars For Sale Online Carvana

Gst Taxation Services Audit And Assurance It Consulting Accounting Services Payroll Outso Life Insurance Premium Accounting Services Secretarial Services

Tesla Delivers Record Number Of Electric Cars In Quarter

Why Are Tesla Electric Vehicles Not Eligible For The Tax Credit

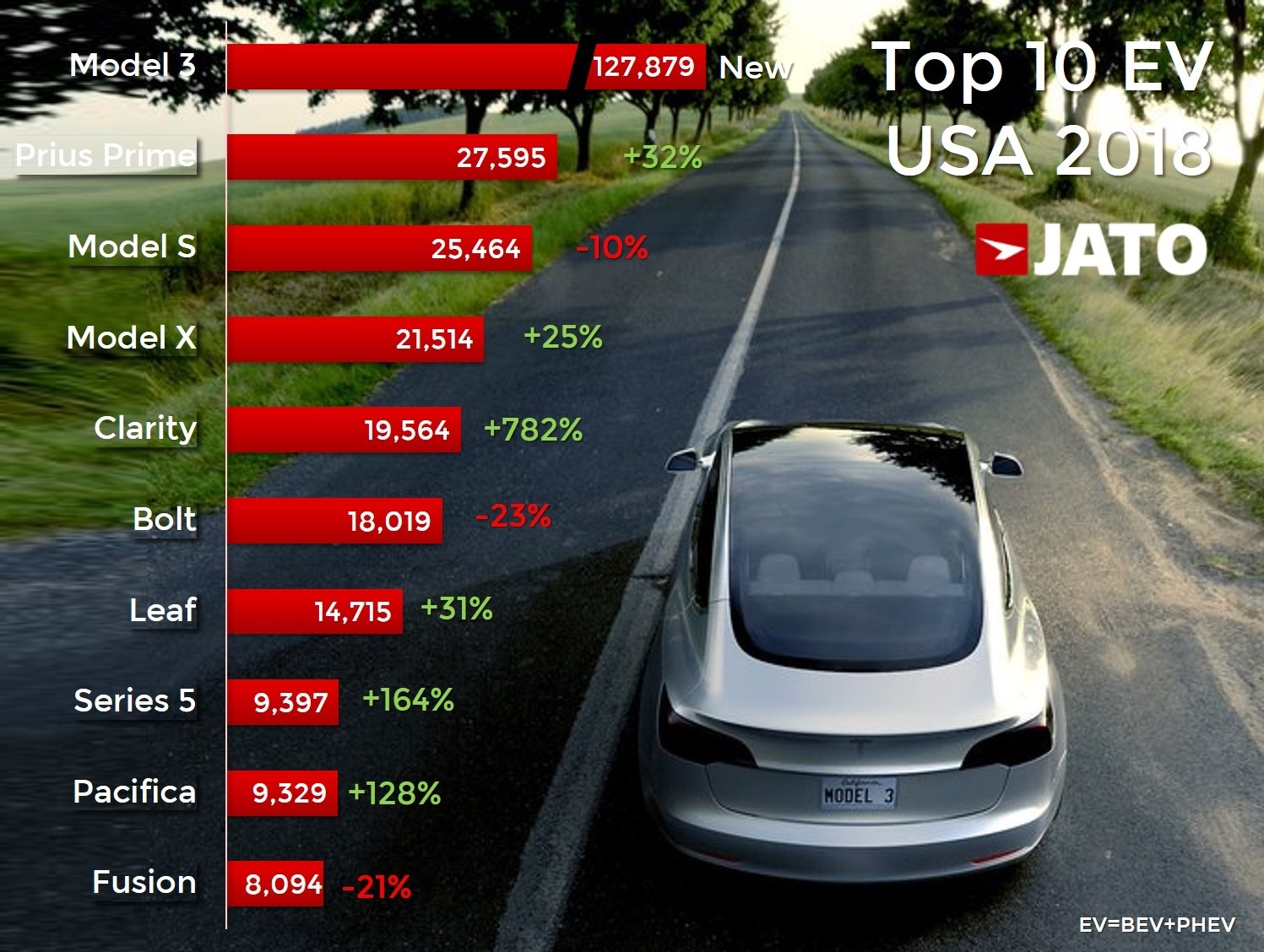

A Breakdown Of The Us Ev Market By State Shows More Incentives Equals More Sales Jato

The Many Advantages Of Evs Will Make You Never Want To Buy A Gas Powered Car Again

Latest On Tesla Ev Tax Credit June 2022

Maryland Ev Tax Credit Status As Of June 2020 Pluginsites

How Much Is A Tesla Lease In 2022 Electrek

2023 Tesla Model X Prices Reviews And Pictures Edmunds

Tesla Model X Tax Write Off 2021 2022

Tesla Model 3 Starting Price Drops

Used Tesla Model S For Sale In Baltimore Md Cargurus

Make The Most Of Your Ride With The Land Rover Explore Mount Http Bit Ly 2iljheh Land Rover Riding Bike Mount

Electric Vehicle Sales Enjoy Boost In Areas Of Minnesota Twin Cities

People Are Getting Tesla S For Free Here S How By Spencer Olson Medium

Maryland Ev Tax Credit Extension Proposed In Clean Cars Act Of 2021 Pluginsites